Digital Banking

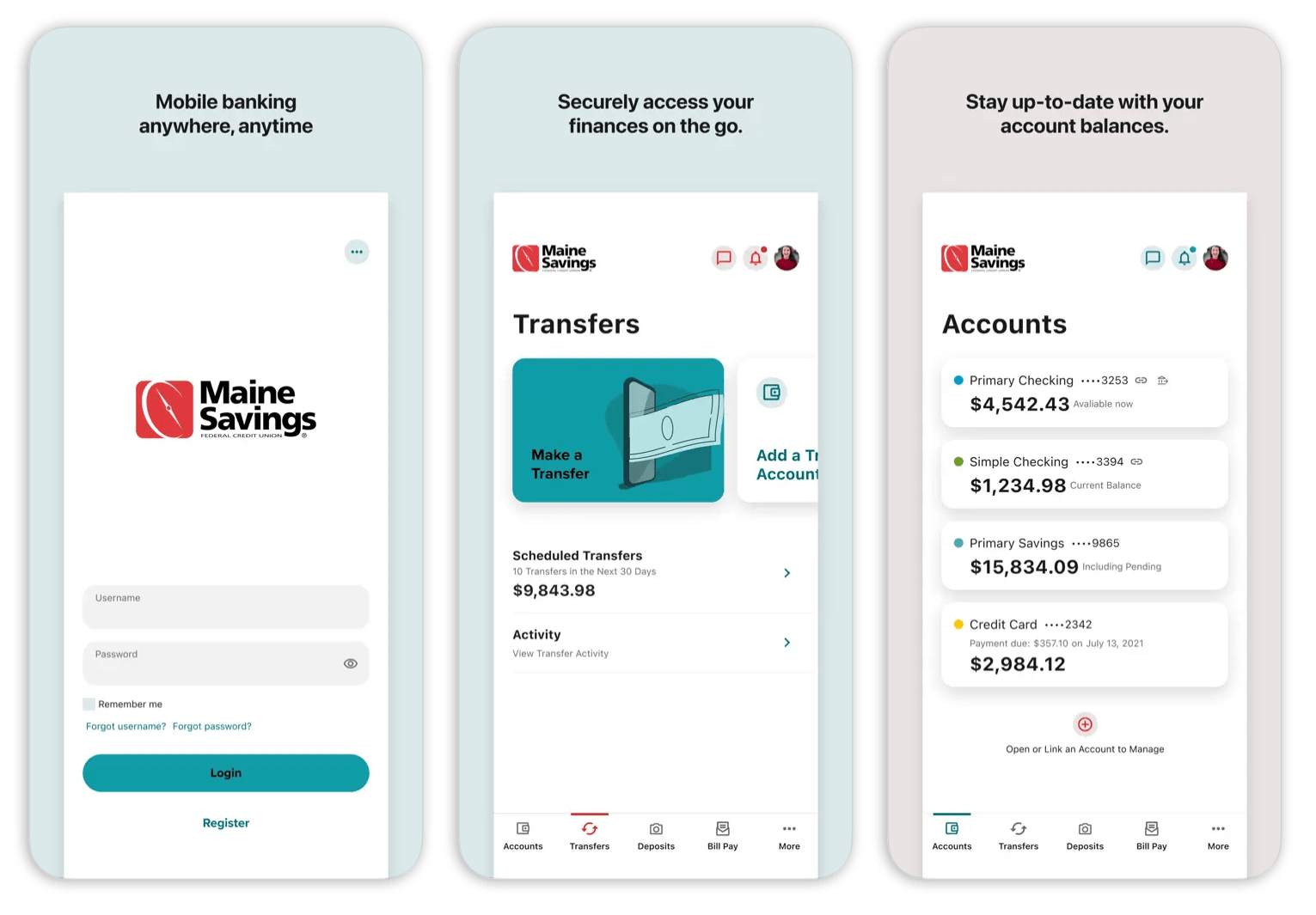

Any banking activities that are completed using a digital device — whether it’s a desktop computer or a mobile banking app. Maine Savings is moving our current online and mobile banking to one seamless digital banking experience.

External Transfers

This feature is currently referred to as Account to Account (A2A) transfers. External Transfers are ACH transactions.

Account Aggregation:

Linking accounts you may have at other financial institutions to your Maine Savings Digital Banking account will enable you to view your assets and liabilities in one place, giving you a complete view of your personal finances.

Primary Account Owner

The person who makes the initial application to open an account or to apply for credit is the primary account owner.

Joint Account Owner

The secondary person on an account. The joint account owner has all the same rights as the primary owner.

Registered User:

Current online banking primary account holder. (You already have a username and access to online banking today).

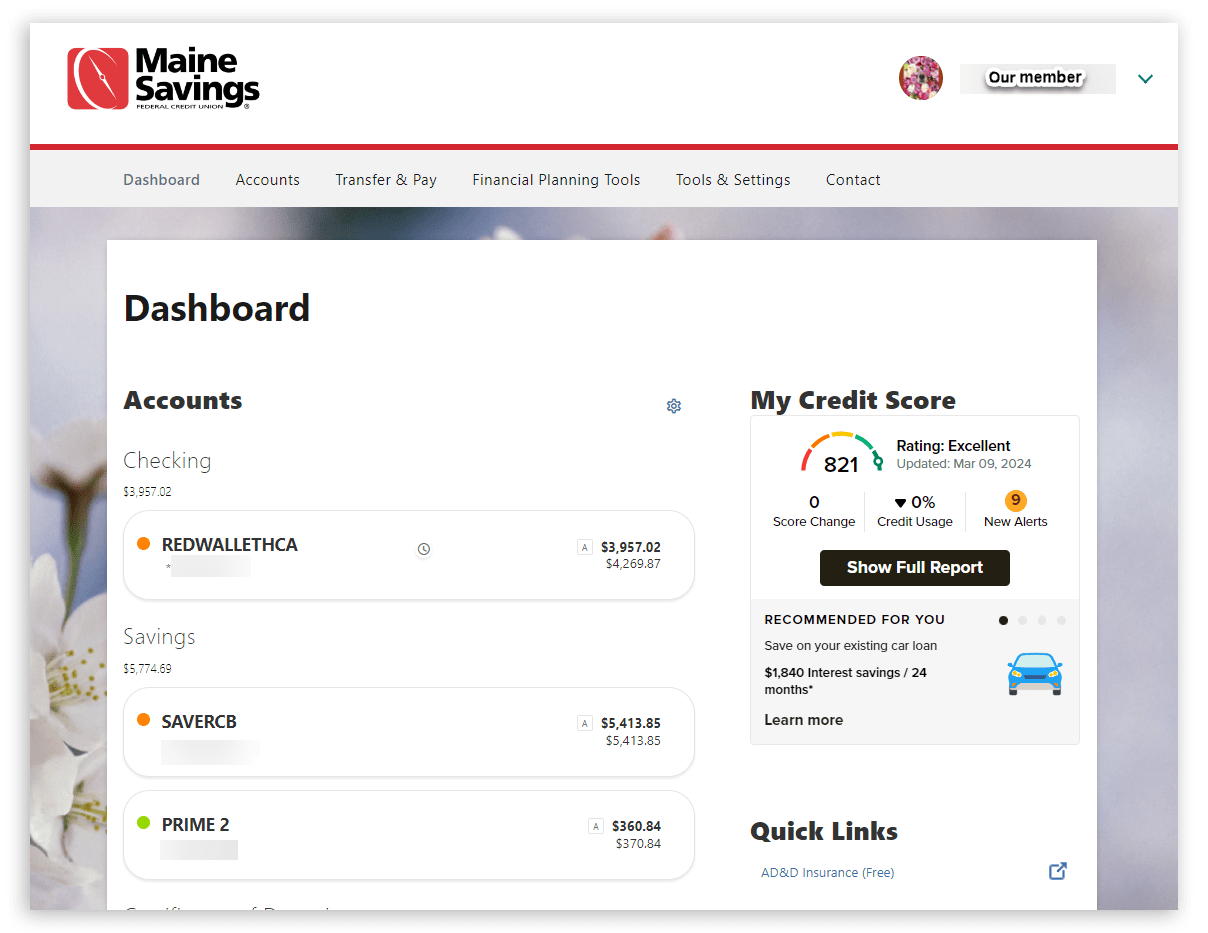

What is Digital Banking?

Any banking activities that are completed using a digital device — whether it’s a desktop computer or a mobile banking app. Maine Savings is moving our current online and mobile banking to one seamless digital banking experience.

What are the best features of Maine Savings’ digital banking?

Our Digital Banking offers many exciting benefits and features to our members:

- Seamless design across desktop, mobile and tablets

- A member-centric focus which means each user will have their own login credentials, allowing them to see accounts associated with their Social Security Number (SSN) or Employer Identification Number (EIN).

- Wires Transfer requests

- RedWallet Rewards tracking

- External account aggregation – Link accounts you have at other financial institutions for viewing in one place

- And so much more!

Will Digital Banking work on my browser and on all devices?

- Browsers Supported: Make sure your browser is within the latest two versions (Safari, Chrome, Edge, Firefox).

- Browser Not Supported: Internet Explorer

- Devices Supported:

- Windows: Versions still supported by Microsoft and support a browser listed above

- OS X: Versions still supported by Apple and support a browser listed above

- Android: Version 7.0+

- iOS: Last two major releases

What are the password requirements?

Your digital banking password will be a minimum of 15 characters, that will only need to be changed annually. Here are some suggestions for creating that password:

- Avoid common words, birthdates or anniversary dates for security reasons.

- Think of a sentence you can remember and use the first letter of each word to formulate your new password.

- Your new password will require at least one of each of the following:

- lowercase letter

- uppercase letter

- special character

- number

- You can use the following special characters:_~@#$%^&*+=`|{}:;!.?()[]-

Why does my password need to be a minimum of 15 characters?

The longer and more complex a password is, the more security you have. We’ve listened to you, and now you will only have to change it once a year!

Can the joint owner on my account share my login credentials?

No. Joint owners will need to register for their own login credentials. Now each member will have their own username and password, allowing members to see accounts associated with their Social Security Number (SSN) or Employer Identification Number (EIN).

How do I know if I am the primary or the joint owner of an account?

If you are the primary owner of the account, your name will appear at the top of the statement, and any joint owner will be listed at the top of the Statement Detail section.

Are biometrics supported with the new Digital Banking?

If the biometric security (facial or fingerprint) on your mobile device is currently activated, you’ll be prompted with biometric set up instructions.

When will my scheduled payments/transfers post?

Transfers scheduled by members via digital banking will post at 7 am and 12:30 pm on business days. These scheduled payments/transfers can be edited through digital banking.

When will my scheduled loan payments that Maine Savings has set up on my behalf post?

Transfers scheduled by Maine Savings will post after 6 pm daily. These scheduled loan payments cannot be edited without contacting Maine Savings.

I am a business member – what information do I need to register for Digital Banking?

You will need your business account number, your business Tax Identification Number (TIN), your business zip code, and a valid email address

If my Maine Savings credit card is held jointly, will the credit card account be visible when I log in?

Yes.

Can I access Digital Banking through the browser on my mobile device?

Yes.

I have forgotten my login credentials and am locked out of Digital Banking. What should I do?

Digital Banking is meant to be completely self-service. Click on either “Forgot username” or “Forgot Password” and follow the steps, or call the Member Service Center (207.862.6500/800.273.6700) for assistance.

Can I set up alerts?

You will have the ability to set up alerts within Digital Banking by going to Settings and clicking on Notifications.

Are eStatements available in Digital Banking?

Yes. If you are currently enrolled to receive eStatements, you will find them in the Documents widget. If you are not currently enrolled to receive eStatements, simply sign up through the Documents widget.

How do I hide/unhide accounts?

Click on Settings and then the Accounts tab. From there you can either hide or unhide an account.

How do I link a view only External Account (account aggregation) to my Maine Savings Digital Banking?

Desktop: From the Dashboard click Link External Accounts and click Get Started. Now you will be guided to setup your external accounts as view only.

Mobile: Scroll down to the bottom of the page and select Link External Accounts to manage your finances all in one place.

Can I transfer funds to and from an external account (ACH) that I have at another financial institution?

Yes. Click on Transfers and then click on Add External Account (ACH).

Can I still deposit a check with my mobile device?

Yes, simply utilize the Check Deposit Widget or the Deposit a Check icon at the top of any deposit account page.

How do I locate an ATM or Shared Branching location with Digital Banking?

Desktop: Click on the Shared Branching Widget.

Mobile: Click on Locations.

How do I transfer funds to another Maine Savings member?

Desktop: Access the Transfers Widget and click on Transfer to another Maine Savings member. You’ll be prompted to enter the account information for the member to whom you’d like to transfer funds.

Mobile: Within the Transfers Widget, you can Add Account at the top of the page. From there you’ll be prompted to enter the account information for the member to whom you’d like to transfer funds.

Where can I find my Loan Payment amount?

Select your loan and click Pay for loan payment details.

Where in Digital Banking can I find the checking account number, also known as MICR?

You’ll find your checking account number (MICR) within Account Details for your checking account.

Where can I find the routing number?

You’ll find the routing number at the bottom of every page in digital banking. Maine Savings routing number is 211288064.

What is the difference between MICR and my checking account number?

There is no difference – your MICR and your checking account numbers are the same.

What if I don’t see a personal account to which I should have access?

If there is an account you are not seeing, please contact us.

How do I set up automatic transfers?

Click on the Transfers option and then select the account the transfer will come from, and the account it will go to, then type the amount of the transfer. Then select the beginning date, frequency, and end date of the automatic transfer. Once all of the information is entered, confirm transfer and you’ll receive a confirmation that the transfer was successful.

Why aren’t I able to edit some of my scheduled transfers?

Scheduled transfers scheduled by Maine Savings (loan payments) are not editable through digital banking. You will need to contact the credit union to discuss rescheduling.

What is “My Credit Score”?

“My Credit Score” is a tool that allows you to monitor your credit activity every 24 hours without negatively affecting your score.

Can I rename an account?

You can change what you call any of your accounts within Digital Banking. Go to Settings, then Accounts. Here you’ll be able to change the nickname as well as color code your accounts however you choose.

How far back does my transaction history go?

History within Digital Banking will be available for up to 24 months.

Will I be able to import/upload my transaction history to Quicken or QuickBooks?

Yes, currently you can download the file format for Quicken or QuickBooks manually. An enhancement is coming by year-end that will allow for full integration with Quicken and QuickBooks.

Can I order checks for my business through Digital Banking?

No. Contact Maine Savings to assist you with ordering your business checks.

Can linked checking accounts be accessed through Bill Pay?

Yes. When you click on the Bill Pay Widget for the first time in Digital Banking, you will be presented with the option to authorize changes. This will allow linked checking accounts to be utilized as a funding source in Bill Pay.